- Created by Jessica Scully, last modified by David Huynh on Dec 06, 2022

Title: |

Financial Management Core Principles |

Publication date: |

12/1/2022 |

Effective date: |

12/1/2022 |

BRIEF

Policy Summary

It is the policy of Lawrence Berkeley National Laboratory (Berkeley Lab) to follow sound financial management practices to steward Berkeley Lab in the performance of Contract 31. Financial stewardship is a shared responsibility among the Office of the Chief Financial Officer (OCFO), Line Management, Lab employees, and all functional elements of Berkeley Lab. This policy sets forth the core principles for financial management and related transactions at Berkeley Lab.

Who Should Read This Policy

- This policy applies to all Berkeley Lab leaders, managers, and employees.

To Read the Full Policy, Go To:

The POLICY tab on this wiki page

Contact Information

Financial Policy and Assurance

Title: |

Financial Management Core Principles |

Publication date: |

12/1/2022 |

Effective date: |

12/1/2022 |

POLICY

A. Purpose

It is the policy of Lawrence Berkeley National Laboratory (Berkeley Lab) to follow sound financial management practices to steward Berkeley Lab in the performance of Contract 31. Financial stewardship is a shared responsibility among the Office of the Chief Financial Officer (OCFO), Line Management, Lab employees, and all functional elements of Berkeley Lab. This policy sets forth the core principles for all financial management and related transactions at Berkeley Lab.

B. Persons Affected

This policy applies to all Berkeley Lab leaders, managers, and employees.

C. Exceptions

Not applicable.

D. Policy Statement

- General

- Berkeley Lab is a Department of Energy (DOE) national laboratory managed by the University of California (UC). The Laboratory is operated under a government-owned contractor-operated (GOCO) model in which the Laboratory is owned by the government and operated by UC under a management and operating (M&O) contract.

- As a steward of the public trust, Berkeley Lab will exercise the highest standards of financial accountability and transparency and will establish and follow sound financial management practices to steward Berkeley Lab effectively.

- The Laboratory is organized along area and divisional lines, with line management responsibilities delegated from the Laboratory Director to the Deputy Directors, Associate Laboratory Directors (ALDs) and Division Directors (DDs). Lab line managers are responsible for understanding and exercising their fiduciary responsibilities in accordance with the Lab’s Stewardship Principles and this and other associated policies.

- Berkeley Lab will perform its financial management responsibilities in accordance with the terms of Contract DE-AC02-05CH11231 (Contract 31) and all other applicable financial rules and regulations, including but not limited to, the Federal Acquisition Regulations (FAR), Cost Accounting Standards (CAS), and generally accepted accounting principles (GAAP).

- Berkeley Lab’s financial records are integrated with the financial records of the DOE. Accordingly, all financial transactions will be classified consistent with applicable requirements in the DOE Financial Management Handbook.

- The Lab's Stewardship Principles include the responsible stewardship of resources managed by the Lab. Financial Stewardship responsibilities encompass comprehensive oversight of the resources assigned to each employee as well as those resources available for use, including the Lab’s funding, people, facilities, and assets. Financial stewardship responsibilities include:

- Spending money prudently and monitoring expenditures.

- Assuring your time, and that of all Lab employees under your oversight, is used appropriately and reported accurately.

- Purchasing goods and services in a prudent business manner through authorized purchasing channels.

- Providing expertise and support to others in their financial stewardship responsibilities.

- Being accountable for your actions, and your use and management of funding, time, Laboratory assets, and other resources.

- Encouraging others to be good stewards of resources within their responsibility.

- Key Financial Roles and Responsibilities

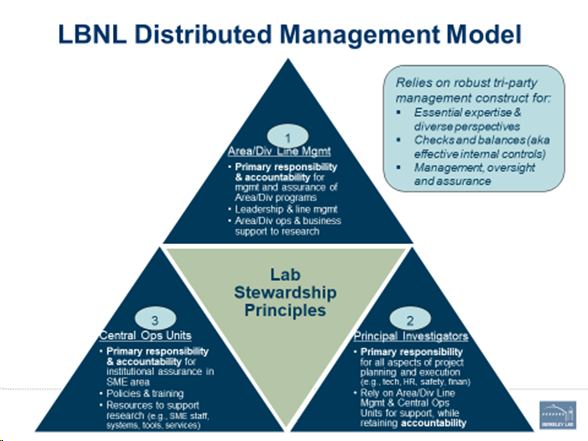

- Financial management is a shared responsibility at Berkeley Lab. All Lab leaders, managers, and employees play a role in ensuring that the Lab’s financial management is effective and financial records are complete and accurate. Berkeley Lab operates under a distributed management model that relies on three key elements/roles: (1) Line Management (e.g., ALDs and DDs); (2) Individual Executors (e.g., Principal Investigators/Project Managers/individuals with budgetary management responsibilities); and (3) Central Operations Units with Subject Matter Expertise (e.g., the OCFO). The Laboratory Director and Deputy Directors have a critical role in setting the tone at the top and making key decisions. For the Lab's distributed model to operate with essential expertise, appropriate management and oversight, and effective internal controls, each element/role must be filled by a qualified and competent individual.

- Key elements of the distributed management model are depicted in the image below.

- In this context, key financial responsibilities are as follows:

- The OCFO is responsible and accountable for designing and implementing financial policies, procedures, training, and controls to ensure that Berkeley Lab has an effective, efficient, and responsive financial management system.

- Area and Division Line Management are responsible and accountable for understanding, exercising, and assuring efficient and effective financial and fiduciary management of all programs, projects, and operations within their units. This includes understanding that the Lab operates under financial rules and policies that differ in fundamental ways from those under which UC campuses and most universities operate.

- For each area/division, the Area/Division Director and his/her senior management team have overall financial responsibility and accountability for all area-/division-managed programs. In this context, senior management teams may include Deputy Division Directors, Deputy Directors for Operations, Business Managers, and other management personnel with budgetary management responsibilities.

- Individuals with budgetary management responsibilities, such as Principal Investigators (PIs) and Project Managers (PMs), have overall financial responsibility and accountability for the programs and projects they manage. This includes ensuring, in consultation with the division’s resource management staff, that costs charged to their projects are allowable and allocable to their projects.

- Resource Analysts (RAs)/Resource Managers are responsible for providing financial support, knowledge, and expertise to the divisions and have financial responsibility and accountability for their services, advice, and actions.

- Further details about specific roles and responsibilities can be found in Section E below and in other associated financial policies.

- Delegation of Authority

- Authority to initiate and/or record financial transactions is delegated from the President of the UC to the Laboratory Director through Delegation of Authority letters. The Laboratory Director further delegates this authority to the positions with responsibility for carrying out the related duties. Within Berkeley Lab, Delegations of Authority are subject to the following key principles:

- While certain actions can be delegated, accountability cannot be delegated.

- A person cannot delegate greater responsibility than he or she has.

- Tasks shall only be delegated to people who are qualified to perform them.

- A qualified person must:

- Be actively involved in the tasks being performed.

- Have the appropriate knowledge and technical skills to perform those tasks, including knowledge of relevant regulations and policies.

- Have the authority to carry out the tasks.

- A person delegating tasks is responsible for ensuring that those tasks are being properly performed.

- Financial transactions may be approved only by Laboratory and/or UC employees with signature authority. See additional information on signature authority in Section D.5.c, below.

- Authority to initiate and/or record financial transactions is delegated from the President of the UC to the Laboratory Director through Delegation of Authority letters. The Laboratory Director further delegates this authority to the positions with responsibility for carrying out the related duties. Within Berkeley Lab, Delegations of Authority are subject to the following key principles:

- Core Financial Requirements

- Overview

- This section describes core financial requirements of Berkeley Lab. For a complete listing of Financial Management policies, please refer to the Requirements and Policies Manual (RPM).

- Funds Control and Costing

- Employees must ensure that funding for their project(s) has been received and included in Contract 31 before beginning any work on the project(s), such as making commitments to hire staff, purchasing goods and services, or incurring other financial obligations. The DOE-approved funding plan (AFP) or contract award alone is not sufficient to begin work

- Employees may spend funds only on the project/activity for which the funds are intended and authorized. All labor, acquisitions/purchases, services, and supplies must be charged to the benefitting project/activity. In addition, the funds must be spent within the time period for which they were authorized.

- Division management is responsible for ensuring that costs do not exceed the funds available for a specific program.

- Employees may only charge costs associated with research activities to projects directly funded by DOE, or another sponsor, or Contractor Sponsored Research (CSR). Research activities should not be included in overhead, organizational burdens, or other indirectly funded activities. The only exception to this is activities funded by Laboratory Directed Research and Development (LDRD).

- All transactions are to be recorded in a timely manner and costs must be recorded in the accounting period in which the services are performed or the goods are received.

- Accruals should be performed as necessary to ensure that costs are recorded in the proper period. For guidance on accruals, please see the Accruals policy.

- If a cost is erroneously recorded to an incorrect project/activity, a resource adjustment should be performed to ensure that costs are recorded to the appropriate project/activity. For guidance on resource adjustments, please see the Resource Adjustments policy.

Berkeley Lab will adhere to the funding categories set forth by the DOE (detailed in the table below).

Funding Category

Limit

Capital Equipment

$500,000

DOE Major Item of Equipment

$5,000,000

Minor Construction Projects: General Plant Project (Program Funded) / Site Minor Construction (formerly known as IGPP) (Indirect Funded) / Accelerator Improvement Projects (AIP)

Less than $25,000,000

Line Item Construction Project

$25,000,000 or greater

- While it may be appropriate for two benefitting projects to share costs, supplementing funding of a federally funded project is prohibited. Employees should seek guidance from the Budget Office and/or the Financial Policy Lead before using more than one funding source for a project.

- The Budget Office and divisions will collaborate to ensure that all indirect costs, including service center costs, are allocated on a basis that distributes the costs equitably to the benefitting projects.

- The Budget Office and divisions will seek to ensure consistency in cost distribution practices over time.

- All projects will be accounted for on a full cost recovery basis. That is, all projects will bear their share of applicable indirect burdens.

- Cost Allowability

- Employees must ensure that costs charged to Contract 31 are allowable. Allowable costs must be necessary, reasonable, allocable, and incurred during the authorized period of performance. Cost allowability requirements are derived from the Federal Acquisition Regulations (FAR) and Contract 31. Refer to the Cost Allowability policy for specific guidance on allowable costs.

- Effort (Time) Reporting

- All employees are required to report their time regularly and accurately by charging the projects that benefit from their effort. This includes certifying the accuracy of their time entries prior to the timekeeping sweep each period. Time estimated between the sweep date and the start of the next LETS period should be reviewed for accuracy and corrected as necessary.

- Exempt staff are required to charge time in accurate proportion to time worked on all benefiting projects.

- Supervisors are responsible for ensuring that effort is reported in a timely manner and for reviewing and approving time for accuracy.

- See the Time and Labor Reporting policy for additional information.

- Acquisitions and Purchases

- All acquisitions/purchases actions at the Lab must comply with applicable laws and federal regulations and the UC-DOE Prime Contract requirements related to purchases, as well as procurement policies and procedures.

- To assure compliance with the applicable regulations/requirements, all acquisitions/purchases must be made through an established purchasing channel, such as eBuy or the PCard program, or through a Lab Procurement buyer with delegated procurement authority.

- Purchases made outside of established purchasing are subject to additional reviews, and are not guaranteed reimbursement.

- Signature authority to incur costs does not grant the authority to commit Laboratory funds to an outside party. Only employees with delegated procurement authority may commit funds on behalf of the Laboratory.

- Refer to the Acquisition of Goods and Services policy and the Procurement & Property Management Make a Purchase web page for additional guidance.

- Proposals for non-DOE Funding

- Proposals for non-DOE funding and integrated contractor orders (ICOs) must be submitted through the Strategic Partnerships Office (SPO).

- Only SPO Contracts Officers are authorized to negotiate directly with sponsors on terms and conditions. The Contracts Officer must identify and get approval from the Chief Financial Officer (CFO) via eSRA for any non-standard financial terms and conditions prior to contract execution. These terms may include, but are not limited to, billing terms, special reporting requirements, special rates, and flow down of procurement clauses.

- SPO Contracts Officers must complete a sponsor eligibility review before a proposal can be submitted. This review includes ensuring the sponsor meets the DOE eligibility requirements and Berkeley Lab's terms and conditions.

- The Division Director or designee provides final division-level review and approval of a project proposal submission in order to ensure overall consistency with the Lab's/division's mission, and for quality control (e.g., accuracy and completeness) purposes.

- The Division Director must obtain approval from the Deputy Director for Operations for commitment of Lab resources and space before a proposal is submitted.

- Property

- All property purchased by Berkeley Lab with DOE funding is U.S. government property and must be used solely for the performance or support of Laboratory work or other purposes authorized by the Lab. Property purchased with non-DOE funding must also be managed in accordance with the Lab’s Property policies.

- Property custodians are responsible for the property assigned to them and must be able to produce assigned property for inventories. In addition, property, regardless of value, may not disposed of outside of Lab processes.

- Berkeley Lab has policies to ensure that equipment donated or loaned to the Lab goes through safety reviews that are comparable to the reviews of equipment acquired through the standard Lab procurement process.

- See the Personal Property Management policy and the Property Management website for more information.

- Travel, Conferences, Meals

- All Lab-paid travel, conferences, and meals are subject to numerous contractual and regulatory restrictions. Employees and line managers should consult the applicable Berkeley Lab policies and procedures before incurring costs. No commitments may be made for these costs before appropriate approvals are in place.

- See the associated policies in the RPM for more information.

- Overview

- Internal Controls

- General: Berkeley Lab will establish an internal control environment that provides reasonable assurance that its financial records are not materially misstated. When designing internal controls, consideration will be given to the cost of the control versus the benefit derived from the control.

- Segregation of Duties: To the maximum extent practicable, Berkeley Lab will maintain a separation of duties between authorizing, processing, recording, and reviewing transactions. Giving consideration to risk, no single individual should have complete control over all processing functions for any financial transaction. Such functions include, but are not limited to:

- Recording transactions into the Financial System directly or through an interfacing system. Authorizing transactions through pre-approval or post audit review.

- Receiving or disbursing funds.

- Reconciling financial system transactions.

- Recording corrections or adjustments

- Signature Authority

- As discussed in Section D.3 above, Laboratory management delegates signature responsibility to control who may approve financial transactions.

- Signature authority allows an employee to approve certain financial transactions in the financial systems.

- Individuals who have signature authority should understand Berkeley Lab’s financial management policies and understand what their certification means.

- Signature authority is not the same as Procurement authority. Only Procurement staff who have delegated Procurement authority may commit Laboratory funds.

- Access to Systems

- The OCFO is responsible for managing the secure stewardship and control of its business and financial systems. This includes maintaining clearly defined roles and permissions, setting up and managing user accounts, and ensuring that users' access privileges and assigned roles are approved and consistent with business need.

- Access to financial management systems will be controlled as described in the Financial Management System (FMS) User Access Control policy.

- Changes to Disclosed Accounting Practices

- The Budget Office will ensure that the Cost Accounting Standards Board (CASB) Disclosure Statement accurately reflects Berkeley Lab’s current accounting practices.

- The division’s Deputy Director for Operations or Business Manager must notify the Budget Office of any changes in accounting practices before implementation.

- Proposed changes to disclosed accounting and financial practices may require review and approval by a DOE contracting officer, as required by FAR 52.230-6, Administration of Cost Accounting Standards. The OCFO will review all proposals for changes to disclosed accounting practices for appropriateness, compliance with CAS, and endorsement of Berkeley Lab senior management prior to submitting such proposals to the DOE for approval.

E. Roles and Responsibilities

All employees have the responsibility to adhere to the provisions of this policy. Key financial management responsibilities are captured in the table below. More details related to financial management responsibilities can be found in individual financial policies in the RPM.

Role |

Responsibility |

Lab Director |

|

Deputy Laboratory Directors |

|

Chief Financial Officer |

|

Controller |

|

Budget Officer |

|

Chief Procurement Officer |

|

Field Finance Manager |

|

Strategic Partnerships Office |

|

Area/Division Managers |

|

Individuals with budgetary management responsibilities (i.e., Project Managers [PMs] / Principal Investigators [PIs]) |

|

Resource Analysts |

|

All Employees |

|

F. Recordkeeping Requirements

None

G. Implementing Documents

None

H. Contact Information

Chief Financial Officer, Financial Policy and Assurance Office

I. Revision History

Date |

Revision |

By whom |

Revision Description |

Section(s) affected |

Change Type |

3/7/2019 |

0 |

T. Carlson |

New Policy to document core financial management principles |

All |

Major |

| 12/1/2022 | 1 | T. Carlson | Minor policy edits for clarification | D | Minor |

DOCUMENT INFORMATION

Title: |

Financial Management Core Principles |

Document number |

11.07.001.000 |

Revision number |

1 |

Publication date: |

12/1/2022 |

Effective date: |

12/1/2022 |

Next review date: |

10/31/2025 |

Policy Area: |

Financial Management |

RPM Section (home) |

OCFO |

RPM Section (cross-reference) |

none |

Functional Division |

OCFO |

Prior reference information (optional) |

RPM Chapter 2.10 |

Source Requirements Documents

- FAR 52.230-2, Cost Accounting Standards (October 2015)

- FAR 52.230-6, Administration of Cost Accounting Standards (June 2010)

- DEAR 970.5232-3, Accounts, Records and Inspection (December 2010)

- DEAR 970.5232-8, Integrated Accounting (December 2000)

- DEAR 970.5232-7, Financial Management System (December 2000)

- DEAR 970.5244-1, Contractor Purchasing System (January 2013) (Deviation Per PF 2011-98, PF 2013-64, PF 2015-17)

- DEAR 970.5245-1, Property (January 2013)

- DOE Financial Management Handbook, Chapter 2.3, Minor Construction Projects

Implementing Documents

None

- No labels

Printed or exported copies of this LBNL policy are not official.

Users are responsible for working with the latest approved revision located in the online LBNL Requirements and Policies Manual.