Title: |

Prepayments and Advance Payments to Others |

Publication date: |

6/28/2022 |

Effective date: |

9/3/2020 |

BRIEF

Policy Summary

This policy describes the requirements for accounting for prepayments and advance payments to others ("advances") at Lawrence Berkeley National Laboratory (Berkeley Lab) to ensure adherence to Department of Energy (DOE) asset accounting requirements.

Who Should Read This Policy

This policy applies to all employees who establish, monitor, or report on prepayments or advances.

To Read the Full Policy, Go To:

The POLICY tab on this wiki page

Contact Information

Title: |

Prepayments and Advance Payments to Others |

Publication date: |

6/28/2022 |

Effective date: |

9/3/2020 |

POLICY

A. Purpose

This policy describes the requirements for accounting for prepayments and advance payments to others ("advances") at Lawrence Berkeley National Laboratory (Berkeley Lab) to ensure adherence to DOE asset accounting requirements.

B. Persons Affected

This policy applies to all employees who establish, monitor, or report on prepayments or advances.

C. Exceptions

This policy does not apply to property, plant, and equipment subject to capitalization and depreciation requirements or inventory. See the Property, Plant, and Equipment (PP&E) and Internal Use Software (IUS) and Inventory policies for additional information on these asset types.

D. Policy Statement

1. General

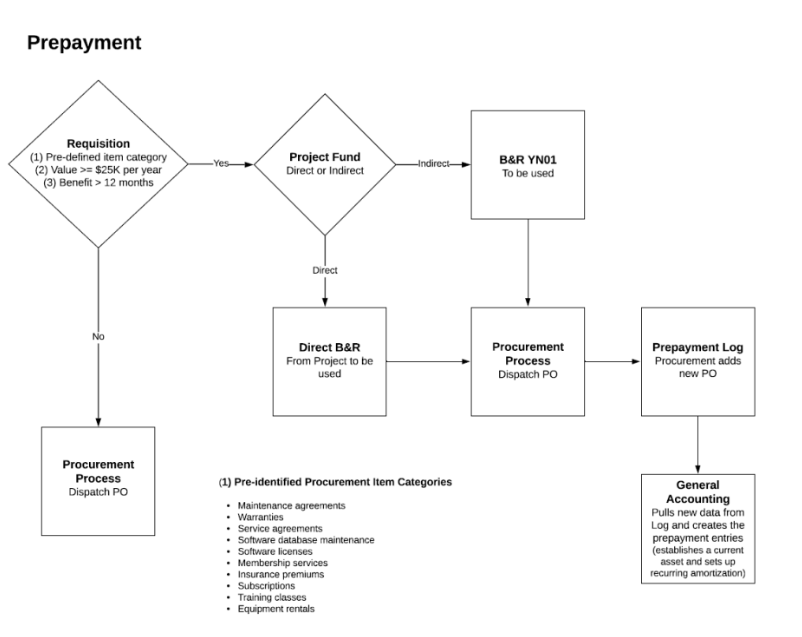

Berkeley Lab accounts for prepayments and advances to others as balance sheet assets, in compliance with the DOE Financial Management Accounting Handbook, Chapter 7.For the purposes of this policy, a "prepayment" is a payment made in one accounting/fiscal period for a service with a benefit that extends over future accounting/fiscal periods. An example of a prepayment is the purchase of an 18-month service agreement. In the month the service agreement is paid for, it is booked as a prepayment asset on the Laboratory's financial statements. The cost of the service agreement is then amortized over the period of the agreement. Other examples of transaction categories that may result in prepayments include:

- Maintenance agreements

- Warranties

- Licenses

- Subscriptions

For the purposes of this policy, an "advance" is a required deposit placed with a third-party entity as a condition of doing business with that entity. An example of an advance is the deposit required by the U.S. Patent Office and Trademark Office (USPTO). The USPTO advance eliminates the need to send payment by check, credit card, or other payment type each time a fee is required.Before a prepayment or advance is accounted for as an asset on the Laboratory's balance sheet, Procurement standard practices must be followed to ensure that procurement advance payment requirements are met (SP 32.1, Subcontract Financing, Payments).The materiality threshold for prepayments has been established as follows:

- Amortization of costs will occur over a period exceeding 12 months.

- Amortization costs per fiscal year will be equal to or exceed $25,000.

Both of the above criteria must be met for a prepayment to be booked as an asset.This policy does not apply to subcontracts with a contract period of one year or less and in which:

- Benefits will be received in the year of the payment.

- Payment will be consistently made each year.

This policy also does not apply if warranty coverage is included in the purchase price of equipment. In this case, the Property, Plant, and Equipment (PP&E) and Internal Use Software (IUS) policy applies.

2. Establishment of Advances on the Balance Sheet

Expenses related to advance payments will be evaluated individually by General Accounting to determine the appropriate accounting treatment.

3. Establishment of Prepayments on the Balance Sheet

The DOE requires that prepayments be funded from a specific Budget and Reporting (B&R) code established for that purpose. That is, all direct funded prepayments must be associated with budget authority from a direct funded B&R code, and all indirect funded prepayments must be associated with the B&R YN01.

4. Recognizing Expenses Related to Prepayments

Through the amortization process, the cost related to a prepayment is spread over the accounting/fiscal periods for which a benefit is received. General Accounting books amortization expense on a monthly basis.

E. Roles and Responsibilities

Managers, supervisors, and employees have the responsibility to adhere to the provisions of this policy.

Role |

Responsibility |

Division: Resource Analyst |

|

Requester |

|

Procurement |

|

Controller's Office/General Accounting |

|

F. Definitions/Acronyms

Term |

Definition |

Advance Payment to Others |

A required deposit placed with a third party as a condition of doing business with that entity |

Amortization |

The allocation of the cost for an intangible asset over its useful service life for accounting purposes |

B&R |

Budget and Reporting. A DOE-defined classification of financial activity prescribed for use in the formulation of budgets for the reporting of obligations, costs, and revenues and for the control and measurement of actual execution versus budgeted performance. |

Prepayment |

A payment made in one accounting/fiscal period for a service with a benefit that extends over future accounting/fiscal periods |

YN01 |

The Budget and Reporting (B&R) value for indirect funded activities performed at Berkeley Lab |

G. Recordkeeping Requirements

None

H. Implementing Documents

I. Contact Information

J. Revision History

Date |

Revision |

By Whom |

Revision Description |

Section(s) Affected |

Change Type |

8/29/2016 |

0 |

M. Beedle |

New policy |

All |

New policy |

9/3/2020 |

1 |

M. Beedle |

Periodic Review |

Minor |

|

9/3/2020 |

1.1 |

Y. Yeung |

Periodic Review |

Minor |

|

6/28/2022 |

1.2 |

Periodic Review: editorial changes. |

Minor |

DOCUMENT INFORMATION

Title: |

Prepayments and Advance Payments to Others |

Document number |

11.01.021.000 |

Revision number |

1.2 |

Publication date: |

6/28/2022 |

Effective date: |

9/3/2020 |

Next review date: |

3/31/2025 |

Policy Area: |

Accounting |

RPM Section (home) |

Financial Management |

RPM Section (cross-reference) |

None |

Functional Division |

OCFO |

Prior reference information (optional) |

Source Requirements Documents

- DOE Financial Management Handbook Chapter 7